Today, we will discuss about Growth oriented plan vs. dividend payout/ income oriented plans in Mutual fund. Also, which scheme would give you better a return on investment. In the earlier articles we discussed about the basics of Mutual funds and benefits of investing in MF.

You will find that there's always G/D written adjacent to a Mutual fund scheme. Many new investors may overlook this because of the lack of awareness of this aspect. “G” stands for Growth oriented plans which provide investors with capital appreciation feature while “D” stands for dividend payout/ income plans that fill investors' pockets with returns at regular intervals as and when declared by the mutual funds.

So, in a growth oriented plan the investors will not receive anything from their investments at regular intervals and nor will they be allotted any additional units rather they will see a growth in the value of their units (i.e. the NAV over time) at a compounding rate. While in the case of dividend pay-out plans the investors receive a certain amount of money at regular intervals from their investment which enables the grown NAV to keep falling back to the original level every time a dividend is paid and get no additional units allotted.

Suppose John invests $200 in a mutual fund of Goldman Sachs (which is the AMC) by choosing a growth oriented plan option (G) for a period of 1 year.

Assuming that his investment makes him a holder of 100 units i.e. 1 unit is worth ($200/100 units) $2.

Now after investing for a year it is time to receive his returns. Say, that the mutual funds scheme gives him a return of 15%. So his investment becomes $230($200+ $200×15%).

And as he owns 100 units the value of each of his units goes up from $2 to ($230/100) $2.3.

Now let's see what happens in the second year. His investment which now stands at $230 by earning a constant return of 15% in the second year will grow from $230 to ($230+$230×15%) $264.5.

Calculation of NAV and return of investment from dividend based fund:

Now suppose Mark invests an equal amount money i.e. $200 in a dividend pay-out/ income plan (D) for a period of 1 year which pays out dividends annually.

Suppose he has been allotted the same number of units i.e. 100 units i.e. each unit has a value (NAV) of $2.

At the end of 1 year, fund gives a return of 15% a dividend of 10% is declared. So his investment value rises to $230. He receives ($200×10%) $20 immediately. Now the value of his investment falls back to $210 i.e. NAV $2.1.

Considering that again the scheme earns 15% returns and declares 10% as a dividend, the $210 at the end of 2nd year becomes $241.5(210+15%*210) by the end of 2nd year, of which $20($200×10%) )is going into Mark's pocket again.

So the NAV drops from $2.415 to $2.215. Thus his net worth has been $221.5+$20+$20=$261.5.

Conclusion:

Hence,on comparison, a dividend pay-out plan (D) opting investor (Mark) sees that at the end of 2 years he has received $20+$20+$11.5=$61.5 from his investment of $200 whereas a Growth oriented plan (G) opting investor (John) has earned $264.5-$200=$64.5 i.e. $3 more.

I hope you were able to understand the concept and difference between Growth and Dividend options in mutual fund. Next we will discuss which investment option is better suited as per your needs.

Read More

10 Factors That Affect Your Car Insurance Premium

12 Common Credit Card Mistakes You Should Avoid

Pros and Cons of Black-box auto insurance

Copyright © ianswer4u.com

You will find that there's always G/D written adjacent to a Mutual fund scheme. Many new investors may overlook this because of the lack of awareness of this aspect. “G” stands for Growth oriented plans which provide investors with capital appreciation feature while “D” stands for dividend payout/ income plans that fill investors' pockets with returns at regular intervals as and when declared by the mutual funds.

So, in a growth oriented plan the investors will not receive anything from their investments at regular intervals and nor will they be allotted any additional units rather they will see a growth in the value of their units (i.e. the NAV over time) at a compounding rate. While in the case of dividend pay-out plans the investors receive a certain amount of money at regular intervals from their investment which enables the grown NAV to keep falling back to the original level every time a dividend is paid and get no additional units allotted.

Example explaining the difference between dividend and growth mutual fund options

Calculation of NAV and return of investment from Growth fund:Suppose John invests $200 in a mutual fund of Goldman Sachs (which is the AMC) by choosing a growth oriented plan option (G) for a period of 1 year.

Assuming that his investment makes him a holder of 100 units i.e. 1 unit is worth ($200/100 units) $2.

Now after investing for a year it is time to receive his returns. Say, that the mutual funds scheme gives him a return of 15%. So his investment becomes $230($200+ $200×15%).

And as he owns 100 units the value of each of his units goes up from $2 to ($230/100) $2.3.

Now let's see what happens in the second year. His investment which now stands at $230 by earning a constant return of 15% in the second year will grow from $230 to ($230+$230×15%) $264.5.

Calculation of NAV and return of investment from dividend based fund:

Now suppose Mark invests an equal amount money i.e. $200 in a dividend pay-out/ income plan (D) for a period of 1 year which pays out dividends annually.

Suppose he has been allotted the same number of units i.e. 100 units i.e. each unit has a value (NAV) of $2.

At the end of 1 year, fund gives a return of 15% a dividend of 10% is declared. So his investment value rises to $230. He receives ($200×10%) $20 immediately. Now the value of his investment falls back to $210 i.e. NAV $2.1.

Considering that again the scheme earns 15% returns and declares 10% as a dividend, the $210 at the end of 2nd year becomes $241.5(210+15%*210) by the end of 2nd year, of which $20($200×10%) )is going into Mark's pocket again.

So the NAV drops from $2.415 to $2.215. Thus his net worth has been $221.5+$20+$20=$261.5.

|

| Example of expected returns in Dividend and Growth based MF |

Conclusion:

Hence,on comparison, a dividend pay-out plan (D) opting investor (Mark) sees that at the end of 2 years he has received $20+$20+$11.5=$61.5 from his investment of $200 whereas a Growth oriented plan (G) opting investor (John) has earned $264.5-$200=$64.5 i.e. $3 more.

I hope you were able to understand the concept and difference between Growth and Dividend options in mutual fund. Next we will discuss which investment option is better suited as per your needs.

Mutual funds: How to choose between growth and dividend in MF?

Benefits of Growth option in Mutual Funds

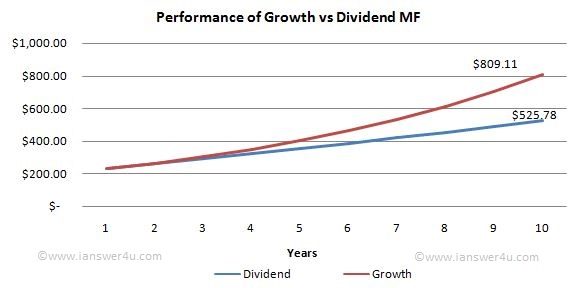

- Growth based funds give a better return on investment over a long period of time. For example if you have invested $200 each in either of schemes which returns 15% YoY and dividend of 10% YOY. Over the period of 10 years the returns you can receive are shown in the below chart.

Long term expected return of investment in growth v/s dividend scheme - You can take advantage of compounding better in growth based funds.

- In some countries, long term capital gains are not taxable, this way the proceeds of growth scheme will not attract any tax liability.

- This option is better suited for long term investor.

Benefits of Dividend option in Mutual Funds

- Opting for this scheme will ensure you will get regular dividend income.

- This option is better suited for a short term investor, for whom a bird in hand is worth two in the bush.

- Dividend option may attract short term taxation, but they provide more liquidity.

Read More

10 Factors That Affect Your Car Insurance Premium

12 Common Credit Card Mistakes You Should Avoid

Pros and Cons of Black-box auto insurance

Copyright © ianswer4u.com

0 Reactions:

Post a Comment